Angela Rayner told renovations offset tax on council house sale

Table Of Content

Military personnel and certain government officials on official extended duty and their spouses can choose to defer the five-year requirement for up to 10 years while on duty. If you inherit a home, the cost basis is the fair market value (FMV) of the property when the original owner died. For example, say you are bequeathed a house for which the original owner paid $50,000. The home was valued at $400,000 at the time of the original owner’s death. The taxable gain is $100,000 ($500,000 sales price - $400,000 cost basis). The Canadian Medical Association is also opposed to the change in capital gains taxes.

Your Silent Business Partner: Capital Gains Rules for Your Primary Residence - North Forty News

Your Silent Business Partner: Capital Gains Rules for Your Primary Residence.

Posted: Wed, 06 Mar 2024 08:00:00 GMT [source]

Long-Term Capital Gains Taxes for Tax Year 2023 (Due April

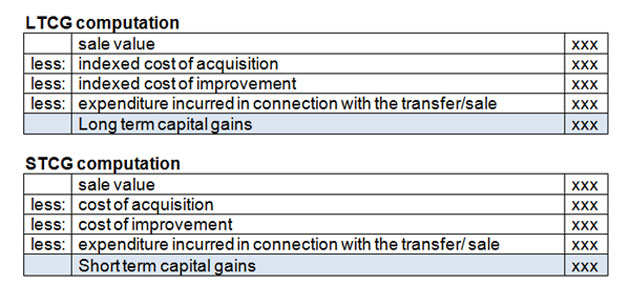

Although the residential real estate market has been up and down lately, your property has likely increased in value since you purchased it. Eventually, when you dispose of the property, either voluntarily or involuntarily, you'll need to determine the federal income tax consequences concerning that built-in appreciation. The long-term capital gains tax rates are much lower than the corresponding tax rates for standard income. You may not need to pay the tax at all if you make less than the minimum amount listed below. If you purchased the capital asset less than a year ago, you’re dealing with a short-term capital gain or loss, and it will be treated as ordinary income. If the purchase took place more than a year ago, that’s a long-term capital gain, which will be given preferential tax treatment, and – if it’s your primary residence – it may even be exempted.

When do I pay the capital gains tax on real estate?

If the vacation home is used by the homeowner for fewer than two weeks in a year and then rented out for the remainder, it is considered an investment property. If you meet the eligibility requirements of the IRS, you’ll be able to sell the home free of capital gains tax. However, there are exceptions to the eligibility requirements, which are outlined on the IRS website.

What Are Capital Losses?

Given their scale, these services generally cost less than attorneys who charge by the hour. A firm that has an established track record in working with these transactions can help you avoid costly missteps and ensure that your 1031 exchange meets the requirements of the tax code. The properties subject to the 1031 exchange must be for business or investment purposes, not for personal use. The party to the 1031 exchange must identify in writing replacement properties within 45 days from the sale and must complete the exchange for a property comparable to that in the notice within 180 days from the sale.

If you hold rental property, the gain or loss when you sell is generally characterized as a capital gain or loss. If held for more than one year, it's long-term capital gain or loss and if held for one year or less, it's short-term capital gain or loss. The gain or loss is the difference between the amount realized on the sale and your tax basis in the property. Fortunately, there are ways to reduce or avoid capital gains taxes on a home sale altogether. The IRS offers a few scenarios to avoid capital gains taxes when selling your house.

US fund loses four-year tax battle from Java House sale - Business Daily

US fund loses four-year tax battle from Java House sale.

Posted: Mon, 29 Apr 2024 04:00:00 GMT [source]

To qualify for a partial exclusion of gain, meaning an exclusion of gain less than the full amount, you must meet one of the situations listed in Does Your Home Qualify for a Partial Exclusion of Gain, later. Married couples filing jointly can exclude up to $500,000 of this gain from their taxes, while individuals and married couples filing separately can exclude up to $250,000. Understanding capital gains taxes for a second home can be difficult, but with adequate knowledge and strategic planning, you can potentially reduce your tax burden and enhance the financial benefits of your sale.

If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. If you don't meet the Eligibility Test, you may still qualify for a partial exclusion of gain. You can meet the requirements for a partial exclusion if the main reason for your home sale was a change in workplace location, a health issue, or an unforeseeable event.

Short-Term Capital Gains Taxes for Tax Year 2023 (Due April

The percentage of the $500,000 or $250,000 gain exclusion that can be taken is equal to the portion of the two-year period that you used the home as a residence. The 2017 Tax Cuts and Jobs Act created opportunity zones — areas around the country identified as economically disadvantaged. If you choose to invest in a designated low-income community, you’ll get a step up in tax basis (your original cost) after the first five years. Under these circumstances, the $50,000 you earned from the sale of the house essentially doubles your income.

Your new cost basis will increase by the amount that you spent to improve your home. A property tax bill is perplexing a small townhouse community in Fergus, Ont. The lifetime exemption limit for farming and fishing properties and small business shares is also increasing.

The policy proposal is much more incremental than revolutionary – aimed, albeit in a small way, at ensuring high earners contribute a fairer portion relative to their massive financial undertakings. Per a 2021 White House release, American billionaires pay an average individual income tax rate of just 8.2%, which might cast them as somewhat less deserving of victim status in the eyes of the average taxpayer. To combat that, policies that would curtail the ability for wealthy individuals to avoid a higher tax bill could employ fearmongering about skyrocketing capital gains rates for ordinary taxpayers. The tax only applies for U.S. citizens and resident aliens, so nonresident aliens are not required to pay it. Most states tax capital gains according to the same tax rates they use for regular income.

The exclusion of income for mortgage debt canceled or forgiven was extended through December 31, 2025. The indebtedness discharged must generally be on a qualified principal residence, and based on an agreement in writing prior to January 1, 2026. See Report as ordinary income on Form 1040, 1040-SR, or 1040-NR applicable canceled or forgiven mortgage debt, later. If the FMV of the property at the time the donor made the gift is less than the donor's adjusted basis, your adjusted basis depends on whether you have a gain or loss when you dispose of the property.

In addition, you must generally reduce your basis by points the seller paid you. If your home was transferred to you by a spouse or ex-spouse (whether in connection with a divorce or not), you can count any time when your spouse owned the home as time when you owned it. Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the above address. Extension of the exclusion of canceled or forgiven mortgage debt from income.

If you have any taxable gain from the sale of your home, you may have to increase your withholding or make estimated tax payments. Complete your “Total” worksheet using the figures for your property as a whole. Include the total amount you received, all of your basis adjustments, etc. Include the cost of all improvements, whether you made them to the business space or the residential space.

Comments

Post a Comment