Topic no 701, Sale of your home Internal Revenue Service

Table Of Content

- Mahendra Singh Dhoni: Captain Cool Meets his Younger Self to Pass on Business Tips

- Avoiding capital gains tax on your primary residence

- Publication 523 ( , Selling Your Home

- Capital gains tax on real estate and selling your home

- Nordea Asset Management: ESG Award Winner in Europe

- Topic no. 409, Capital gains and losses

- Steve Fechheimer: Brewing Up a Storm to Combat Climate Change

Additional information on capital gains and losses is available in Publication 550 and Publication 544. If you sell your main home, refer to Topic no. 701, Topic no. 703 and Publication 523, Selling Your Home. Fortunately, there are ways to avoid or reduce the capital gains tax on a home sale to keep as much profit in your pocket as possible. To learn more about the capital gains tax on real estate properties, review the following frequently asked questions.

Capital Gains Tax On Real Estate: A Guide - Zing! Blog by Quicken Loans

Capital Gains Tax On Real Estate: A Guide.

Posted: Wed, 03 Jan 2024 08:00:00 GMT [source]

Mahendra Singh Dhoni: Captain Cool Meets his Younger Self to Pass on Business Tips

The percentage you pay on your capital gains depends on your filing status and how much money you made last year. Let’s say you bought your home 2 years ago and it’s increased in value by $10,000. You may be required to pay the capital gains tax on the amount you profit from selling your home.

Avoiding capital gains tax on your primary residence

The result is the amount you can use in figuring your itemized deductions. If you determined in Does Your Home Sale Qualify for the Exclusion of Gain, earlier, that your home sale doesn't qualify for any exclusion (either full or partial), then your entire gain is taxable. In either case, you don’t need to complete Worksheet 3 and you can skip to Reporting Your Home Sale, later.

Publication 523 ( , Selling Your Home

You generally treat this amount as capital gain or loss, but you may also have ordinary income to report. Many homeowners are aware of the general tax rule for home sales. If you have owned and lived in your main home for at least two of the five years leading up to the sale, up to $250,000 ($500,000 for joint filers) of your gain is tax-free. Any gain over the $250,000 or $500,000 exclusion is taxed at capital gains rates. Because rental properties and second homes are considered assets, you may be subject to pay the capital gains tax. However, there are also ways to avoid paying the tax on these property types, especially if they’ve increased in value in recent years.

If you co-owned the home with your spouse, add the adjusted basis of your spouse's half-share in the home to the adjusted basis of your own half-share to get your starting basis. (In most cases, the adjusted basis of the two half-shares will be the same.) The rules apply whether or not you received anything in exchange for the home. The Eligibility Test determines whether you are eligible for the maximum exclusion of gain ($250,000 or $500,000 if married filing jointly).

Almost everything you own and use for personal or investment purposes is a capital asset. Examples of capital assets include a home, personal-use items like household furnishings, and stocks or bonds held as investments. When you sell a capital asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss. Generally, an asset's basis is its cost to the owner, but if you received the asset as a gift or inheritance, refer to Publication 551, Basis of Assets for information about your basis. You have a capital gain if you sell the asset for more than your adjusted basis.

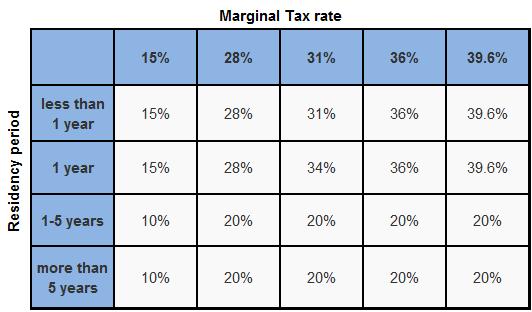

As you may have guessed, short-term capital gains tax rates tend to be a bit higher than long-term rates for people with the same income levels and filing statuses. A rental property doesn’t have the same exclusions as a primary residence when it comes to capital gains taxes. Understanding Capital Gains Capital gains refer to the profit made from the sale of assets such as stocks, real estate, or businesses. The federal capital gains tax rate varies based on income level, asset type, and holding period. Long-term capital gains, those on assets held for more than a year, are generally taxed at a lower rate than short-term gains. Currently, the top rate is 20% for long-term gains, but the proposed budget aims to change that (Welcome to Mondaq).

The period before the exchange that is after the last date the property was used as a main home is not considered nonqualified use for purposes of the proration rules of section 121. To figure basis of the property received in the exchange (replacement property), any gain excluded under section 121 is added to your basis of your replacement property, similar to the treatment of recognized gain. This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home.

Steve Fechheimer: Brewing Up a Storm to Combat Climate Change

In essence, it's the government recapturing the savings you enjoyed due to the depreciation deduction. You pay capital gains tax only on the difference between what you sell the house for, and the amount it was worth when your last parent died. The capital gains tax on your home sale depends on the amount of profit you make from the sale. Profit is generally defined as the difference between how much you paid for the home and how much you sold it for. Remember that, in any case, certain factors, such as any depreciation claimed for the home, may affect capital gains tax.

How To Navigate Capital Gains Taxes In A Challenging Real Estate Market - Forbes

How To Navigate Capital Gains Taxes In A Challenging Real Estate Market.

Posted: Wed, 03 Apr 2024 07:00:00 GMT [source]

When you file your federal taxes, the IRS would consider your gross income for that year to be $100,000. Let’s say Mom and Dad bought the family home years ago for $100,000, and it’s worth $1 million when it’s left to you. When you sell, your purchase price (or “basis”) is not the $100,000 your folks paid, but instead the $1 million it’s worth on the last parent’s date of death. However, there are certain criteria you must meet to qualify for the home sale exclusion. Here is more of what you need to know to help determine whether you qualify. Finally, add your selling costs, like real estate agent commissions and attorney fees, as well as any transfer taxes you incurred.

Also, if your sale of vacant land meets all these requirements, you must treat that sale and the sale of your home as a single transaction for tax purposes, meaning that you may apply the exclusion only once. For those married and filing separately, earnings up to $47,025 are taxed at 0%, $47,025 to $291,850 at 15% and above $291,850 at 20%. Let's say you buy some stock for a low price and after a certain period of time the value of that stock has risen substantially. You decide you want to sell your stock and capitalize on the increase in value. The 1031 exchange rules are very complicated and tricky, with many requirements to meet.

Others say that it costs you more in the long run because you're selling assets that could appreciate in the future for a short-term tax break.. And if you repurchase the stock, you're essentially deferring your capital gains taxation to a later year. Critics of tax-loss harvesting also point out that since Congress can make changes to the tax code, you could also run the risk of paying high taxes when you sell your assets later. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%.

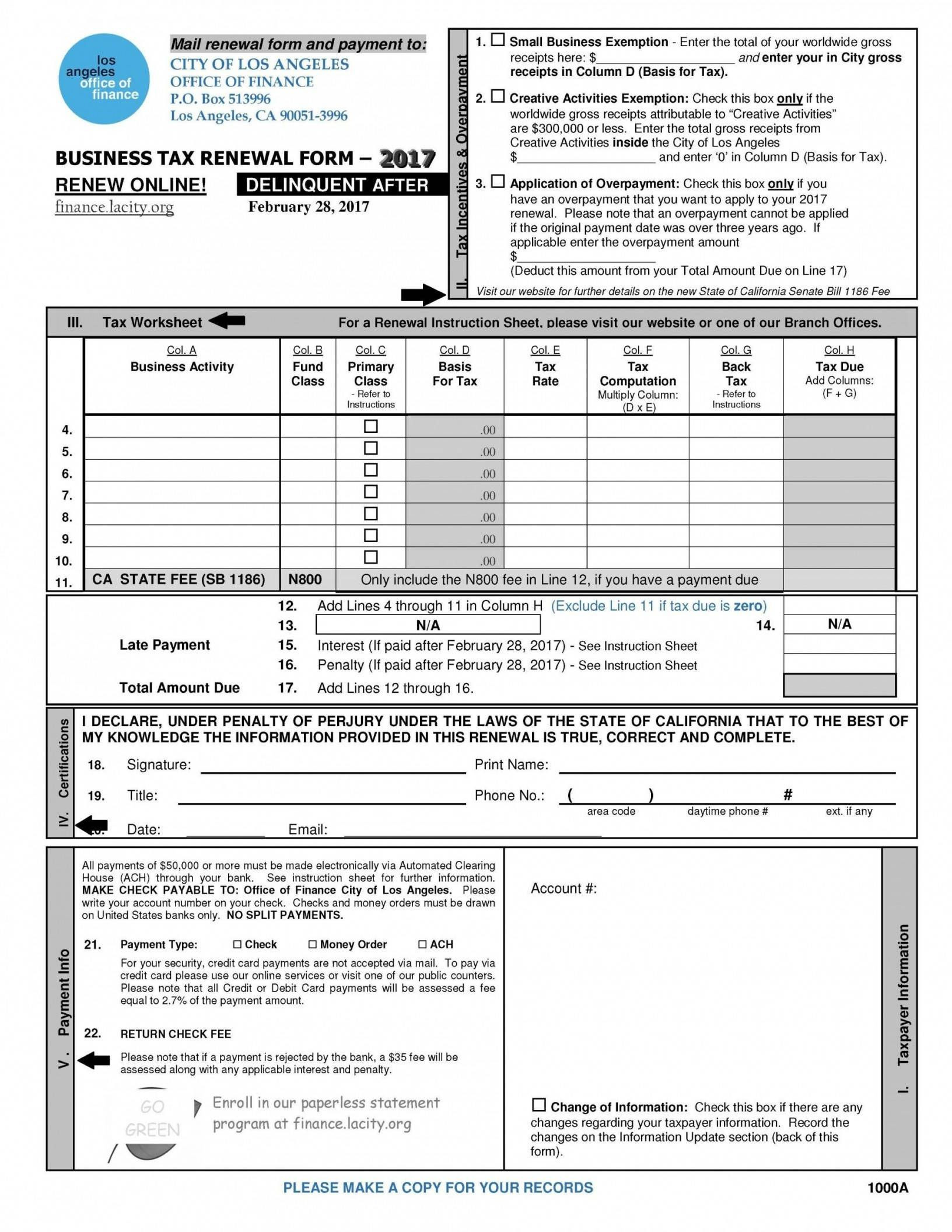

You must report the sale of a home if you received a Form 1099-S reporting the proceeds from the sale or if there is a non-excludable gain. Form 1099-S is an IRS tax form reporting the sale or exchange of real estate. This form is usually issued by the real estate agency, closing company, or mortgage lender.

Comments

Post a Comment